The world of capital markets has changed dramatically over the past few years. Today, most transactions are conducted electronically and rely on sophisticated technology. In addition, blockchain-based applications are being used to facilitate transactions in complex financial instruments such as derivatives and bonds. These changes mean that investors must have a solid understanding of how various types of securities are traded, as well as the role that technology plays in this process.

There are several key challenges that capital markets face when it comes to technology. High-frequency trading (HFT) is a particularly complex issue, as regulators struggle to keep up with the speed at which these transactions occur. Market data quality is also a concern, as inaccurate information can have far-reaching consequences. Data security is another important consideration, as financial institutions must protect sensitive information from cyber threats. Finally, the role of technology in algorithmic trading and the interaction between human traders and computers is an ongoing topic of debate.

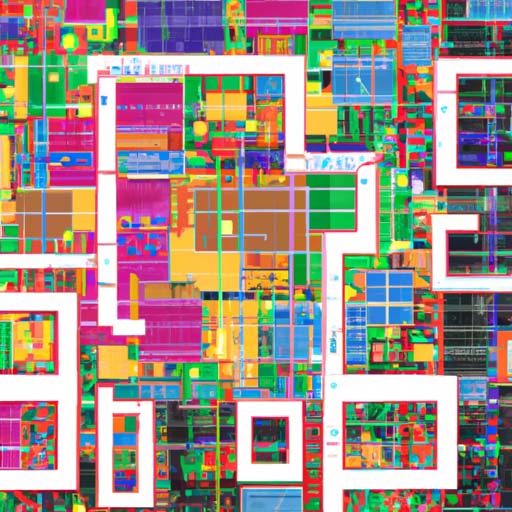

Technology plays a crucial role in capital market operations, particularly in risk management, trading and settlement, and data management. Cloud computing and SaaS are commonly used in these areas, as they offer flexibility and cost savings. Algorithmic trading and high-frequency trading have also become increasingly important in capital markets, as they allow traders to make more efficient decisions based on vast amounts of data. Blockchain and distributed ledger technology have the potential to revolutionize capital markets by providing secure and transparent transactions. Finally, artificial intelligence is being used to predict market trends and monitor compliance regulations.

In conclusion, the world of capital markets is becoming increasingly reliant on technology. Investors must understand how various types of securities are traded and the role that technology plays in this process. There are several key challenges that capital markets face, including high-frequency trading, market data quality, data security, and the interaction between human traders and computers. However, technology also offers many opportunities for improvement, particularly in risk management, trading and settlement, and data management. As the world of capital markets continues to evolve, it will be interesting to see how technology shapes this industry.